- 🟨 The Yellowbrick Road

- Posts

- YB new stock pitches (Fri, Oct 31)

YB new stock pitches (Fri, Oct 31)

Hello!

I significantly underestimated how much work I’d be able to get done while travelling yesterday, so this email is a day late.

I’ve just added 54 new pitches to the website.

As always, you can visit the website to see all of the stock pitches and search/filter them at https://www.joinyellowbrick.com (if you are a premium member, make sure to login so you get the most recent pitches).

Thanks for reading!

Connor (founder of Yellowbrick and CEO Watcher)

P.S. - if you want a condensed, links-only view of the stock pitches for faster browsing, you can find it at https://www.joinyellowbrick.com/links

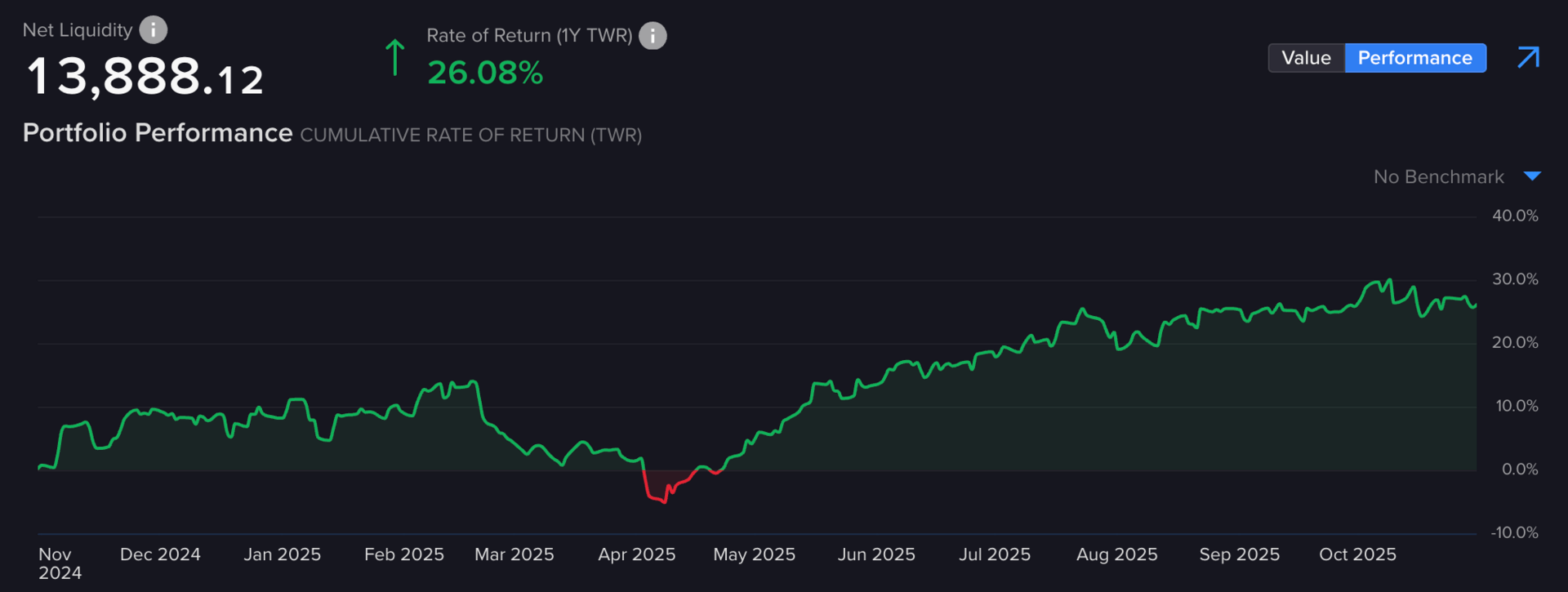

YB PORTFOLIO

The YB Tracking Portfolio holds ~30 stocks that were pitched by the best performing investors out of the 2,000+ investors that Yellowbrick tracks. All new trades are shared with Premium subscribers in this email and Premium subs can see the current holdings here.

Last 1y returns (IBKR took away the “all” option)

HIGHLIGHTED PITCHES (FREE)

Author Returns

The below stock pitch is from Anfa Partners.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

ANALYST REPORT - Anfa Partners

InterDigital: An Asset-Light Toll Road Play for Wireless, Video, and Artificial Intelligence

InterDigital, Inc. operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Ticker: IDCC | Price: $361.96 | Price Target: $700 (+94%)

Market Cap: $9.36B | Timeframe: N/A

🔎 R&D Research | 🚨 Special Situation | 📈 Bullish Idea

InterDigital (IDCC) trades at $379 with a $700 price target (+85% upside) based on the expected Disney litigation catalyst in H1'26 that should unlock monetization of its untapped Streaming & Cloud Services (SCS) division. The company operates as an asset-light R&D and licensing firm with 430 employees generating $550M+ in adjusted EBITDA, currently earning ~$475M ARR from smartphone licensing (covering 85% of global smartphone vendors including Apple since 2016 and Samsung's recent $1B eight-year agreement). IDCC's SCS division holds critical video compression codecs (HEVC, VVC) essential for 4K/8K streaming, AR/VR, and AI video applications, with management targeting $300M ARR by 2030 though the streaming market TAM ($465B, 11% CAGR) is approaching smartphone TAM ($470B, 3% CAGR). Recent legal wins include a Brazil injunction against Disney, world's first anti-interim-license injunctions in Germany against Amazon, and DOJ support in the US, with courts finding IDCC's encoder claims are not subject to RAND obligations, enabling higher licensing rates and injunction threats. The business displays 60%+ EBITDA margins, 60%+ ROCE, 100% cash conversion, and asset-light toll road characteristics around wireless, video, and AI technologies. Key risks include potential US patent system overhaul (value-based 'patent tax'), UK courts becoming global FRAND arbiters, and the inherent complexity of patent law potentially preventing proper market valuation, though the company trades at 23x 2026E P/E for what the authors consider a defensive, high-quality technology business benefiting from secular AI and streaming growth trends.

Read the full article here. Read time: 31 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/124926/?ref=PLACEHOLDER

Author Returns

The below stock pitch is from Tactile Fund.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

FUND LETTER - Tactile Fund

Tactile Fund Portfolio Holding: Conrad Industries, Inc.

Conrad Industries, Inc. engages in the construction, conversion, and repair of various steel and aluminum marine vessels in the United States.

Ticker: CNRD | Price: $26.83 | Price Target: N/A

Market Cap: $134M | Timeframe: N/A

⚓️ Marine Vessel Construction | 📈 Bullish Idea

Conrad Industries (CNRD), a shipbuilder and the best performer in Tactile Fund's holdings this year, is benefiting from an upturn in the domestic shipbuilding industry with strong orders from government and general industrial customers. While energy companies have historically been large Conrad customers, the company has yet to receive meaningful new orders from drillers and energy transportation companies, presenting a potential catalyst for accelerated recovery if energy customers return to the orderbook. Additionally, Conrad recently received an order from a venture capital-backed producer of autonomous marine drones, which, while difficult to assess in terms of meaningful revenues or profit at this early stage, represents an encouraging sign and potential upside optionality for the company.

Read the full article here. Read time: 1 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/124905/?ref=PLACEHOLDER

Author Returns

The below stock pitch is from Glasshouse Research.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

ANALYST REPORT - Glasshouse Research

[SHORT] Bad Times Ducommun

Ducommun Incorporated provides engineering and manufacturing services for products and applications used in the aerospace and defense, industrial, medical, and other industries in the United States.

Ticker: DCO | Price: $91.75 | Price Target: $25 (-73%)

Market Cap: $1.37B | Timeframe: N/A

🏗️ Engineering/Manufacturing | 🛩️ Aerospace | 📉 Short Idea

Ducommun Incorporated (DCO) is assigned a Strong Sell rating with a $25 price target, representing -60% downside, based on aggressive ASC 606 revenue recognition that has artificially pulled forward $61.3 million in FY24 revenue. Key red flags include contract assets growing 5.1% YOY while revenue increased only 2.7%, days-sales-outstanding reaching a 5-year high of 97 days, and days-sales-in-inventory doubling to 121 days since 2018 from 67 days, indicating warehouses full of undeliverable parts due to customer delays from Boeing and RTX. The company's backlog is rolling over with a concerning 0.70x book-to-bill ratio, while being heavily concentrated in struggling aerospace primes including Boeing (8.2% of revenue) facing 737 MAX production caps and RTX (18.5% of revenue) dealing with multi-billion-dollar engine defects. CEO compensation reached $21.3 million or 67.6% of GAAP net income versus 9% at peers, driven by non-GAAP metrics that run ~4x GAAP net income through recurring 'one-time' exclusions. The company has a history of SEC scrutiny, reported material weaknesses in revenue recognition controls in 2023 with PwC issuing an adverse ICFR opinion, and former executives confirm a culture of 'finding revenue' at quarter-end by exploiting ASC 606 flexibility to recognize revenue when material and labor hit the floor, resulting in never missing earnings targets but creating unsustainable working capital bloat that positions the stock for a significant 'big bath' period and valuation reset.

Read the full article here. Read time: 26 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/124928/?ref=PLACEHOLDER

Find all of the stock pitches on https://joinyellowbrick.com (30-day delay for free subscribers).

Unlock all stock pitches (plus historic author returns and Elite Investor Feeds) by upgrading to Yellowbrick Premium.

THE REST OF THE PITCHES

To get access to all of the stock pitches, upgrade to Yellowbrick Road Premium. If part of your job is idea generation (either for your personal account or a fund), it’s a no-brainer.

🎁 REFERRAL PROGRAM 🎁

Use your unique URL below or the share URL for any of the stock pitches to unlock insanely valuable awards.

Premium members have access to these awards here.

THAT’S ALL FOLKS

Thank you so much for reading today’s email! Your support is the only way I can write this email for free every day.

Give me feedback in the poll below and share the newsletter with other investors if you find it useful!

Connor

*Follow Yellowbrick on Twitter at @joinyellowbrick

How would you rate today's newsletter?If you vote 1 or 3 stars, please leave a comment with what you didn't like so I can improve it! |

Reply