- 🟨 The Yellowbrick Road

- Posts

- YB new stock pitches (Thu, Jul 17)

YB new stock pitches (Thu, Jul 17)

Hello!

I’ve just added 57 new pitches to the website.

As always, you can visit the website to see all of the stock pitches and search/filter them at https://www.joinyellowbrick.com (if you are a premium member, make sure to login so you get the most recent pitches).

Thanks for reading!

Connor (founder of Yellowbrick and CEO Watcher)

P.S. - if you want a condensed, links-only view of the stock pitches for faster browsing, you can find it at https://www.joinyellowbrick.com/links

YB PORTFOLIO

The YB Tracking Portfolio holds ~30 stocks that were pitched by the best performing investors out of the 2,000+ investors that Yellowbrick tracks. All new trades are shared with Premium subscribers in this email and Premium subs can see the current holdings here.

Started May 2024

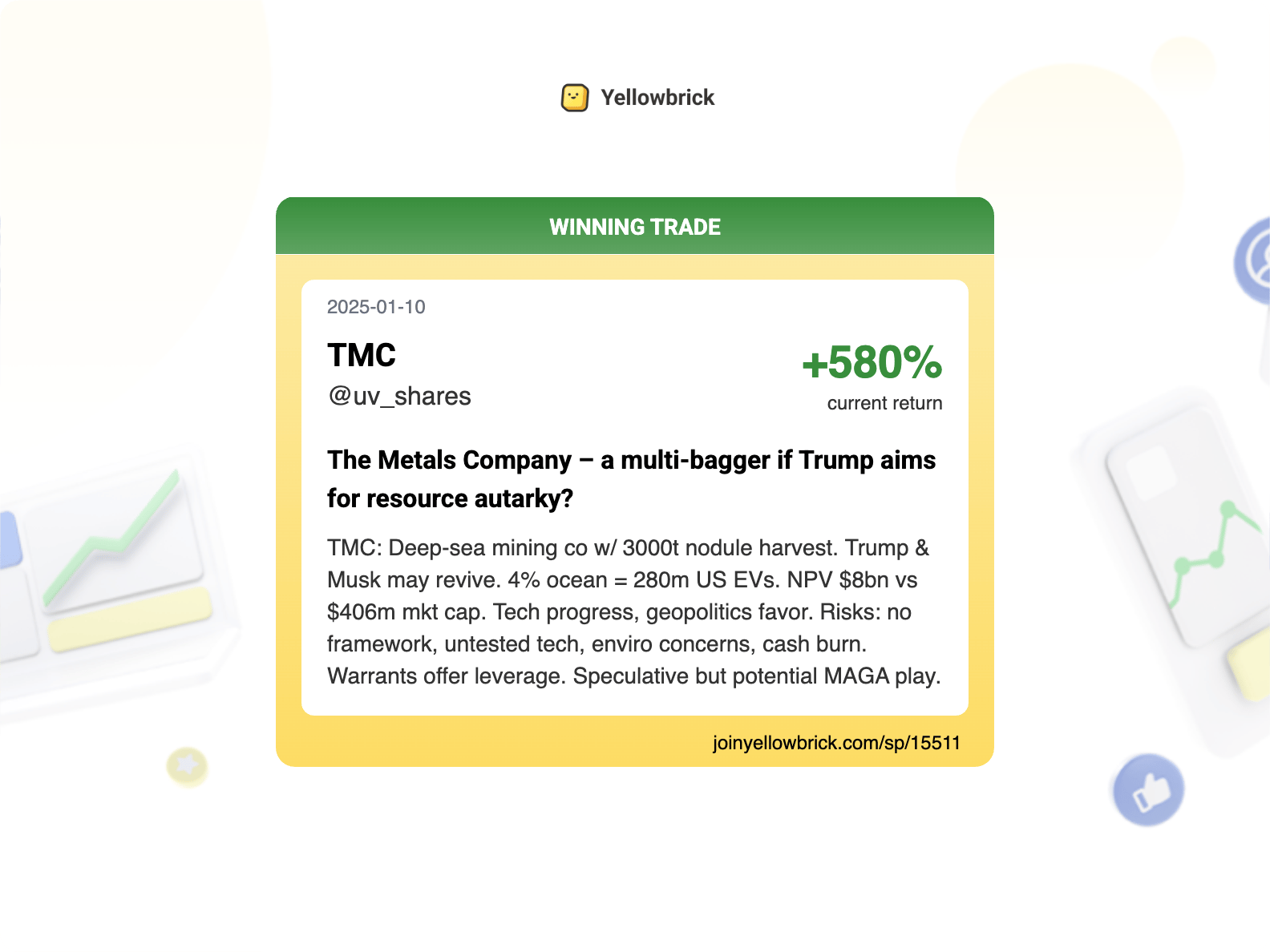

WINNING PITCH

580% returns in 2025

This pitch for The Metals Company ($TMC) from Undervalued Shares (@uv_shares on X) from the beginning of the year is already up almost 600% (link)

If you aren’t using https://www.joinyellowbrick.com, you are missing out on tons of killer stock pitches! Hint: check out the Elite Investor Feeds.

HIGHLIGHTED PITCHES (FREE)

Author Returns

The below stock pitch is from Scalper's Lounge.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

BLOG POST - Scalper's Lounge

I'm extremely long energy - Helix Energy Solutions Group, Inc.

Helix Energy Solutions Group, Inc., together with its subsidiaries, an offshore energy services company, provides specialty services to the offshore energy industry in Brazil, the United States, North Sea, the Asia Pacific, West Africa, and internationally.

Ticker: HLX | Price: $6.30 | Price Target: N/A

Market Cap: $949M | Timeframe: N/A

🛢️ Offshore Energy Services | 📈 Bullish Idea

Helix Energy Solutions Group (HLX) presents an investment opportunity highlighted by Gate City Capital's significant 11% position, with their thesis centered on contract resets driving value. The company benefits from a substantial depreciation/capex mismatch where maintenance capital expenditures for specialized vessels are running considerably below depreciation charges, resulting in approximately 20% free cash flow yield. HLX's robotics segment offers additional upside potential as a 'free right tail' opportunity. The company's offshore sector exposure is differentiated from peers, though specific details about this differentiation aren't provided.

Read the full article here. Read time: 1 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/120034/?ref=PLACEHOLDER

Author Returns

The below stock pitch is from Patient Capital Management.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

FUND LETTER - Patient Capital Management

Patient Capital Management New Position: Noble Corporation plc

Noble Corporation plc operates as an offshore drilling contractor for the oil and gas industry worldwide.

Ticker: NE | Price: $26.82 | Price Target: N/A

Market Cap: $4.27B | Timeframe: N/A

🛢️ Offshore Drilling | 💰 7.5% Dividend | 📈 Bullish Idea

Noble Corporation plc (NE) is a leading offshore drilling contractor positioned to benefit as growth in land-based oil production slows. The industry has consolidated significantly since 2019, with only four major players remaining, while nearly 50% of deepwater rigs have been scrapped over the past decade, creating supply constraints that should persist for years due to minimal capital investment. Despite recent rate pressures, Noble's 2025 guidance is fully backed by its contracted backlog, and the company's focus on cost discipline is expected to drive margin expansion and strong free cash flow generation. Management has committed to returning 100% of free cash flow to shareholders through both a 7% dividend yield and share repurchases representing 8% of outstanding shares. Noble is well-positioned to further consolidate the sector and benefit from improving offshore market conditions over the long term.

Read the full article here. Read time: 1 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/120052/?ref=PLACEHOLDER

Author Returns

The below stock pitch is from Upslope Capital Management.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

FUND LETTER - Upslope Capital Management

Upslope Capital Management New Position: Smiths Group plc

Smiths Group plc operates as an industrial technology company in Americas, Europe, the Asia Pacific, and internationally.

Ticker: SMIN.L | Price: GBP 23.56 | Price Target: N/A

Market Cap: GBP 7.77B | Timeframe: N/A

🏗️ Industrial Conglomerate | 💰 2% Dividend | 📈 Bullish Idea

Smiths Group plc (SMIN.L) is a UK-based industrial conglomerate with four segments: John Crane (48% of operating profit), Flex-Tek (24%), Smiths Detection (15%), and Smiths Interconnect (13%). The company is undergoing significant transformation, planning to exit the Interconnect unit by year-end and the Detection unit next year to focus on its core businesses. These core units benefit from high recurring revenue (70%+ for John Crane), strong competitive positions, and consistently deliver mid-20s ROCE with steady mid-single digit organic growth. Key catalysts include this portfolio reshaping and an aggressive buyback program that has reduced shares outstanding by nearly 15% since July 2021, with an additional £350 million (5% of market cap) authorized in January. Despite these catalysts and a strong balance sheet (<0.5x net debt versus historical 1-2x), Smiths trades at reasonable historical multiples of 11x NTM EBITDA and 17x P/E. Key risks include potential delays in restructuring, exposure to cyclical energy/industrial downturns, cybersecurity threats (including an early 2025 incident), and foreign exchange risk as approximately 75% of revenue comes from outside Europe, primarily the US.

Read the full article here. Read time: 2 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/120030/?ref=PLACEHOLDER

Find all of the stock pitches on https://joinyellowbrick.com (30-day delay for free subscribers).

Unlock all stock pitches (plus historic author returns and Elite Investor Feeds) by upgrading to Yellowbrick Premium.

THE REST OF THE PITCHES

To get access to all of the stock pitches, upgrade to Yellowbrick Road Premium. If part of your job is idea generation (either for your personal account or a fund), it’s a no-brainer.

🎁 REFERRAL PROGRAM 🎁

Use your unique URL below or the share URL for any of the stock pitches to unlock insanely valuable awards.

Premium members have access to these awards here.

THAT’S ALL FOLKS

Thank you so much for reading today’s email! Your support is the only way I can write this email for free every day.

Give me feedback in the poll below and share the newsletter with other investors if you find it useful!

Connor

*Follow Yellowbrick on Twitter at @joinyellowbrick

How would you rate today's newsletter?If you vote 1 or 3 stars, please leave a comment with what you didn't like so I can improve it! |

Reply