- 🟨 The Yellowbrick Road

- Posts

- YB new stock pitches (Thu, Sep 4)

YB new stock pitches (Thu, Sep 4)

Hello!

I’ve just added 58 new pitches to the website.

As always, you can visit the website to see all of the stock pitches and search/filter them at https://www.joinyellowbrick.com (if you are a premium member, make sure to login so you get the most recent pitches).

Thanks for reading!

Connor (founder of Yellowbrick and CEO Watcher)

P.S. - if you want a condensed, links-only view of the stock pitches for faster browsing, you can find it at https://www.joinyellowbrick.com/links

YB PORTFOLIO

New Trade Alert!

We just made a new trade in the YB Premium Portfolio.

The new stock is…

The YBR Portfolio is only available to Premium Subscribers. If you want to know which stocks the top investors are investing in, upgrade to Yellowbrick Premium.

Returns

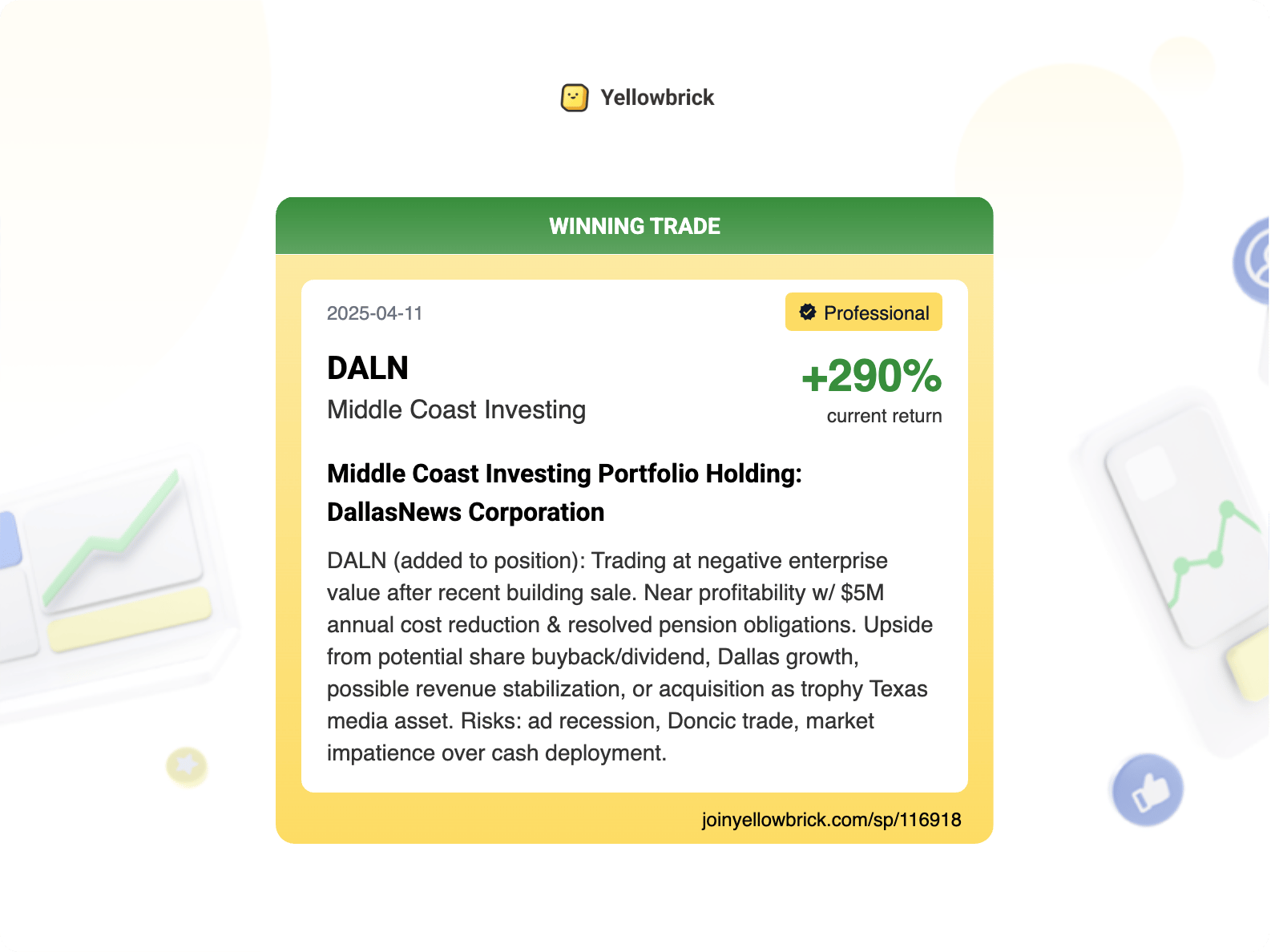

WINNING PITCH

+300% returns in 6 months

Dallasnews Corp (DALN) is up almost 300% since Middle Coast Investing bottom-ticked it in their fund letter (link).

If you aren’t using https://www.joinyellowbrick.com, you are missing out on tons of killer stock pitches! Hint: check out the Elite Investor Feeds.

HIGHLIGHTED PITCHES (FREE)

Author Returns

The below stock pitch is from finn520.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

VALUE INVESTORS CLUB - finn520

Ziff Davis, Inc. - $ZD

Ziff Davis, Inc., together with its subsidiaries, operates as a digital media and internet company in the United States and internationally.

Ticker: ZD | Price: $36.97 | Price Target: N/A

Market Cap: $1.78B | Timeframe: N/A

📱 Digital Media Conglomerate | 📈 Bullish Idea

Ziff Davis (ZD), a digital media conglomerate of 90+ niche acquisitions across 5 verticals (Technology & Shopping, Gaming & Entertainment, Health & Wellness, Connectivity, and Cybersecurity & Martech), trades at just 2.8x EBITDAS and 4x EBITA despite generating 35% EBITDA margins on $1.4 billion revenue and $494 million Adj EBITDAS in 2024. The company has historically achieved 16-17% ROIC on M&A while targeting 20% returns, with $3.2 billion spent on acquisitions over 12 years producing current EBITDA of $523 million. Management has repurchased 10% of the float in the last 12 months at ~$50/share and made insider purchases at $40-50, with the CEO buying $500k in shares and indicating they will be aggressive if the stock remains low. While organic revenue has been declining at -3% in Q1 2025 (improving from -5% in 2022), 2025 guidance calls for $1.472 billion revenue (5% growth), $523 million Adj EBITDAS (6% growth), and $6.96 Non-GAAP EPS (5% growth). The stock trades at $30.96 with a $1,310 million market cap and $267 million net debt, representing an EV of $1,577 million. The primary risk is AI disruption to the content business, though management notes only 14% of traffic comes from search, and the company's focus on niche apps with user-generated content and data provides some differentiation from generic websites.

Read the full article here. Read time: 5 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/122175/?ref=PLACEHOLDER

Author Returns

The below stock pitch is from bentley883.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

VALUE INVESTORS CLUB - bentley883

Basic-Fit N.V. - $BFIT.AS

Basic-Fit N.V., together with its subsidiaries, engages in the operation of fitness clubs. It operates clubs under Basic-Fit brand in the Netherlands, Belgium, Luxembourg, Germany, France, and Spain.

Ticker: BFIT.AS | Price: EUR 25.00 | Price Target: EUR 65 (+160%)

Market Cap: EUR 1.65B | Timeframe: N/A

🏋️ Fitness Clubs | 📈 Bullish Idea

Basic-Fit N.V. (BFIT.AS), the dominant Western European low-cost gym operator with 1,616 locations across six countries, trades at a trough multiple of 5.3x 2026E EBITDA versus its historical 9-13x range, presenting compelling risk/reward with a target price of €65 (>100% upside) based on 10x 2027E EBITDA of €529 million. The company's competitive advantages include being 15-20% cheaper than competitors, superior cost structure with 30-40% lower equipment costs than independents, faster payback periods (3-4 years with 30% ROIC), and a clustering strategy that creates market dominance. Four major catalysts center on France (54% of clubs): 1) an 80% probability that a French labor law change will eliminate the current €35 million annual staffing cost for 24/7 operations, 2) expanding 24/7 access across all 875 French gyms which should add ~170,000 members generating €50 million revenue and €40 million EBITDA, 3) insourcing expensive contractors to reduce labor costs by half, and 4) progressing toward fully staffless operations. These catalysts could drive 2026 EBITDA to €455-500 million versus €404 million consensus, representing 15-20% upside to estimates. The company has overcome post-COVID headwinds in France where gyms were closed 11 months and recent cohorts underperformed, but 2023-2025 openings have returned to historical performance levels. Long-term growth remains attractive with European gym penetration at 11-18% versus mid-twenties in the US, and management targeting 3,000-3,500 total clubs with significant expansion opportunities in Germany (37 gyms targeting 650-900), Spain (220 gyms with capacity to double), and continued growth in France where Basic-Fit holds 16% market share in a fragmented industry.

Read the full article here. Read time: 18 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/122231/?ref=PLACEHOLDER

Author Returns

The below stock pitch is from Kubang Pasu Capital.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

BLOG POST - Kubang Pasu Capital

Grand Bank Yachts (GBY)

Grand Banks Yachts Limited, together with its subsidiaries, manufactures and sells luxury recreational motor yachts in the United States, Australia, Europe, and Asia.

Ticker: G50.SI | Price: SGD 0.62 | Price Target: SGD 1.07 (+73%)

Market Cap: SGD 115M | Timeframe: N/A

🛥️ Yacht Builder | 💰 2.5% Dividend | 📈 Bullish Idea

Grand Banks Yachts Limited (G50.SI), a premium yacht builder trading at S$0.58 per share, presents an 84% upside opportunity with a target price of S$1.07 based on multiple expansion from its current 5.9x TTM P/E to 9x (compared to European peers at 10-17x P/E). The company has transformed with a new +25% capacity Johor composites facility that just came online, a Newport Rhode Island marina acquisition for deeper U.S. market penetration, and a record S$156.6 million net order book (+31% YoY) comprising 33 new boats plus 13 trade-ins. Despite temporary margin dilution from trade-ins reducing blended gross margins to 29.9% in FY2025, build-to-order (BTO) unit economics still generate ~36% gross margins, and revenue has grown from S$96.1m (FY2021) to S$162.3m (FY2025) with profit after tax increasing from S$4.2m to S$18.2m over the same period. The company maintains a strong balance sheet with S$51.5 million in cash against S$7.2 million in borrowings, trading at 3.3x EV/EBIT and 1.06x P/B. Key catalysts include margin normalization as trade-ins recede and BTO reasserts itself, operating leverage from the new Johor facility enabling larger models and better throughput, aftermarket revenue growth from the Newport beachhead, and new higher-ASP models like the PB107 and GT50 RS Outboard. Bear case risks include continued soft backdrop with lingering trade-ins and weak USD leading to a 6x multiple and S$0.50 target, while the base case assumes backlog conversion and mix normalization driving the 9x multiple and S$1.07 target.

Read the full article here. Read time: 4 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/7009/?ref=PLACEHOLDER

Find all of the stock pitches on https://joinyellowbrick.com (30-day delay for free subscribers).

Unlock all stock pitches (plus historic author returns and Elite Investor Feeds) by upgrading to Yellowbrick Premium.

THE REST OF THE PITCHES

To get access to all of the stock pitches, upgrade to Yellowbrick Road Premium. If part of your job is idea generation (either for your personal account or a fund), it’s a no-brainer.

🎁 REFERRAL PROGRAM 🎁

Use your unique URL below or the share URL for any of the stock pitches to unlock insanely valuable awards.

Premium members have access to these awards here.

THAT’S ALL FOLKS

Thank you so much for reading today’s email! Your support is the only way I can write this email for free every day.

Give me feedback in the poll below and share the newsletter with other investors if you find it useful!

Connor

*Follow Yellowbrick on Twitter at @joinyellowbrick

How would you rate today's newsletter?If you vote 1 or 3 stars, please leave a comment with what you didn't like so I can improve it! |

Reply