- 🟨 The Yellowbrick Road

- Posts

- YB new stock pitches (Tue, Jul 1)

YB new stock pitches (Tue, Jul 1)

Hello!

I’ve just added 48 new pitches to the website.

As always, you can visit the website to see all of the stock pitches and search/filter them at https://www.joinyellowbrick.com (if you are a premium member, make sure to login so you get the most recent pitches).

Thanks for reading!

Connor (founder of Yellowbrick and CEO Watcher)

P.S. - if you want a condensed, links-only view of the stock pitches for faster browsing, you can find it at https://www.joinyellowbrick.com/links

YB PORTFOLIO

The YB Tracking Portfolio holds ~30 stocks that were pitched by the best performing investors out of the 2,000+ investors that Yellowbrick tracks. All new trades are shared with Premium subscribers in this email and Premium subs can see the current holdings here.

Last 1y returns

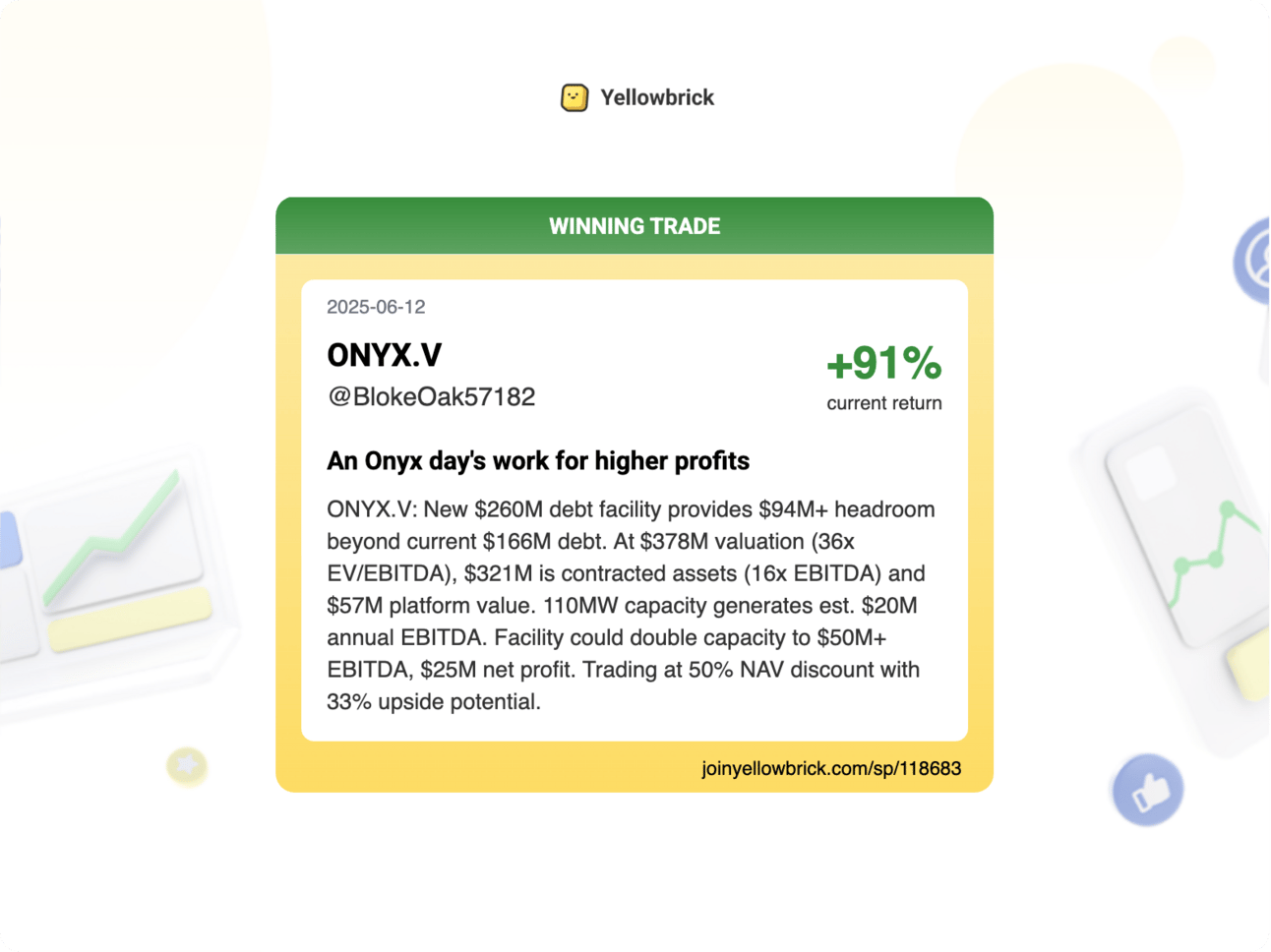

WINNING PITCH

+90% in 3 weeks

This Onyx pitch by The Oak Bloke is already up 90% in just a few weeks since we added it to the site (link).

If you aren’t using https://www.joinyellowbrick.com, you are missing out on tons of killer stock pitches! Hint: check out the Elite Investor Feeds.

HIGHLIGHTED PITCHES (FREE)

Author Returns

The below stock pitch is from Penny Queen.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

BLOG POST - Penny Queen

$CISO: Investors Are Still Pricing CheckLight Like Antivirus

CISO Global Inc. operates as a cybersecurity, compliance, and software company in the United States, Chile, and internationally.

Ticker: CISO | Price: $1.14 | Price Target: $5 (+339%)

Market Cap: $37M | Timeframe: N/A

🔒 Cybersecurity | 📈 Bullish Idea

CISO Global Inc. (CISO) is a cybersecurity company trading at 1x revenue compared to peers at 7-20x, with Q4 2024 projected as its first EBITDA profitable quarter and 2025 projections of $34M in recurring cybersecurity revenue and $5M in high-margin CheckLight software bookings (80%+ margins). The company has transformed from a pure services business into a hybrid security and software model, with its CheckLight platform offering a $1.5M warranty that covers business interruption, data loss, ransom payments, and third-party liability. CheckLight is uniquely distributed through insurance advisors rather than IT consultants, targeting the 93% of North American small businesses lacking cyber insurance. In one deployment with a U.S. religious institution, CheckLight reduced annual breach-related losses from $500,000-$750,000 to zero within 12 months. Despite recent share price volatility following a reduced $100M shelf filing (down from $300M), upcoming catalysts include a potential CUSIP change, insider buying after blackout periods, and institutional access at $2-5 price points. The price target is $5 based on the current model, with higher potential as SaaS revenue scales, particularly if the company achieves even modest penetration of the 30 million uninsured SMB market.

Read the full article here. Read time: 5 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/119346/?ref=PLACEHOLDER

Author Returns

The below stock pitch is from Scalper's Lounge.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

BLOG POST - Scalper's Lounge

Sunday Market Prep - Ideas for the week ahead: CorMedix Inc.

CorMedix Inc., a biopharmaceutical company, focuses on developing and commercializing therapeutic products for life-threatening diseases and conditions in the United States.

Ticker: CRMD | Price: $12.06 | Price Target: N/A

Market Cap: $818M | Timeframe: N/A

🧪 Biopharma | 🚨 Special Sit | 📈 Bullish Idea

CorMedix Inc. (Ticker: CRMD) experienced a stock drop to $12.50 following the announcement of a secondary offering priced at approximately $12.80, equating to around a 10% dilution. Although dilution is typically disliked by shareholders, I believe the resulting decline is an overreaction. The company is positioned in a high-risk, high-reward market, developing solutions to diminish catheter-related bloodstream infections, backed by robust science. Management has upped their sales forecast, yet the uncertainty lies in the long-term stabilization of new product pricing. I currently hold a position exceeding 3% in the company.

Read the full article here. Read time: 1 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/119325/?ref=PLACEHOLDER

Author Returns

The below stock pitch is from Shrimp Among Whales.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

BLOG POST - Shrimp Among Whales

GLXY Ain't Built in a Day

Galaxy Digital Inc. engages in the digital asset and blockchain businesses. It operates through three segments: Global Markets, Asset Management, and Digital Infrastructure Solutions.

Ticker: GLXY | Price: $21.33 | Price Target: N/A

Market Cap: $8.3B | Timeframe: N/A

🪙 Crypto | 🤖 Data Center | 📈 Bullish Idea

Galaxy Digital (GLXY) is transforming from a crypto company to a data center powerhouse, with its Helios campus featuring 800MW capacity (600MW already contracted to CoreWeave) projected to generate approximately $20 billion in revenue at a 90% EBITDA margin. The company has an additional 1.7GW under study, potentially making Helios the largest U.S. data center. Despite holding a strong $2.7 billion balance sheet, GLXY stock has underperformed compared to peers like Circle and CoreWeave. CEO Mike Novogratz sold 3% of his holdings but still maintains a 52% stake, pledging not to sell more shares while the stock remains 'cheap.' Key catalysts include increased visibility and storytelling to change perception beyond being just a crypto beta play, Phase I financing confirmation (seeking $4 billion from European banks), CoreWeave's decision on the remaining 200MW option, and a Board of Directors refresh to add stronger operational expertise. The company aims to transition from a volatile P&L driven by digital asset fluctuations to generating stable annual FCF of $550-600 million within two years, with AI/HPC agreements expected to yield $15 billion in rent over 15 years.

Read the full article here. Read time: 7 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/119332/?ref=PLACEHOLDER

Find all of the stock pitches on https://joinyellowbrick.com (30-day delay for free subscribers).

Unlock all stock pitches (plus historic author returns and Elite Investor Feeds) by upgrading to Yellowbrick Premium.

THE REST OF THE PITCHES

To get access to all of the stock pitches, upgrade to Yellowbrick Road Premium. If part of your job is idea generation (either for your personal account or a fund), it’s a no-brainer.

🎁 REFERRAL PROGRAM 🎁

Use your unique URL below or the share URL for any of the stock pitches to unlock insanely valuable awards.

Premium members have access to these awards here.

THAT’S ALL FOLKS

Thank you so much for reading today’s email! Your support is the only way I can write this email for free every day.

Give me feedback in the poll below and share the newsletter with other investors if you find it useful!

Connor

*Follow Yellowbrick on Twitter at @joinyellowbrick

How would you rate today's newsletter?If you vote 1 or 3 stars, please leave a comment with what you didn't like so I can improve it! |

Reply