- 🟨 The Yellowbrick Road

- Posts

- YB new stock pitches (Tue, Sep 9)

YB new stock pitches (Tue, Sep 9)

Hello!

Note: there may be an issue with this email not including all of the pitches for paid subscribers. If that is the case, you can always find them at joinyellowbrick.com

I’ve just added 54 new pitches to the website.

As always, you can visit the website to see all of the stock pitches and search/filter them at https://www.joinyellowbrick.com (if you are a premium member, make sure to login so you get the most recent pitches).

Thanks for reading!

Connor (founder of Yellowbrick and CEO Watcher)

P.S. - if you want a condensed, links-only view of the stock pitches for faster browsing, you can find it at https://www.joinyellowbrick.com/links

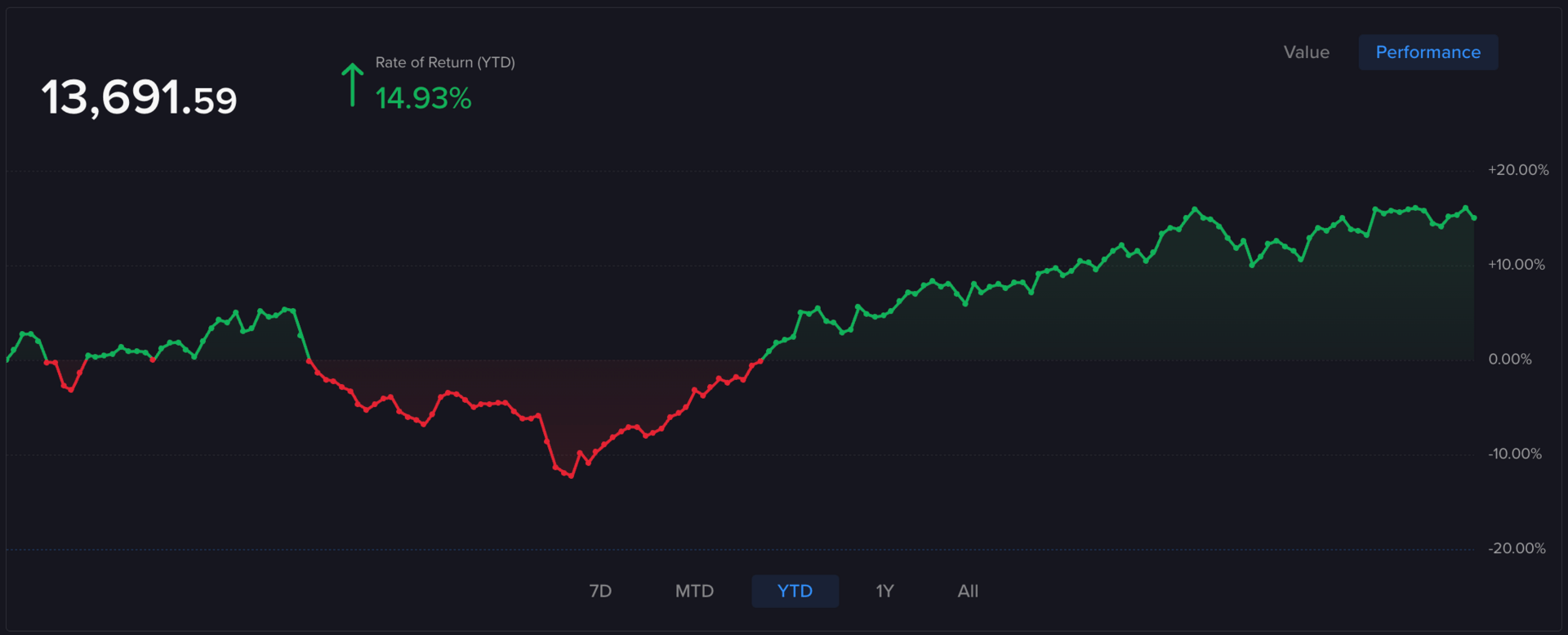

YB PORTFOLIO

The YB Tracking Portfolio holds ~30 stocks that were pitched by the best performing investors out of the 2,000+ investors that Yellowbrick tracks. All new trades are shared with Premium subscribers in this email and Premium subs can see the current holdings here.

Started May 2024

HIGHLIGHTED PITCHES (FREE)

Author Returns

The below stock pitch is from cuyler1903.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

VALUE INVESTORS CLUB - cuyler1903

Quest Diagnostics Incorporated - $DGX

Quest Diagnostics Incorporated provides diagnostic testing and services in the United States and internationally. The company develops and delivers diagnostic information services, such as routine, non-routine and advanced clinical testing, anatomic pathology testing, and other diagnostic information services.

Ticker: DGX | Price: $182.76 | Price Target: $230 (+26%)

Market Cap: $20.44B | Timeframe: 2027

🩺 Diagnostics | 💰 1.75% Dividend | 📈 Bullish Idea

Quest Diagnostics (DGX), a leading provider of diagnostic health information services based in Secaucus, New Jersey, serves roughly 50% of hospitals and physicians, 33% of US adults, and over 90% of insured lives, operating in what is essentially a duopoly with Laboratory Corporation of America (LabCorp) in the clinical laboratory industry. The company generated $9.9 billion of revenue and $1.9 billion of EBITDA in 2024, and is projected to generate $11.2 billion of revenue, $2.3 billion of EBITDA, and $1.2 billion of free cash flow in 2026. The investment thesis rests on five key pillars: the favorable duopolistic industry structure that provides significant pricing power and rational pricing environment with hospitals increasingly outsourcing lab services; the recurring, habitual nature of diagnostic testing creating a 'sticky' customer base with high switching costs and predictable revenue streams; the unfortunate tailwind of a progressively unhealthier American population with rising rates of obesity, diabetes, and chronic diseases driving increased testing demand; growing societal appreciation for early diagnostic insights following increased awareness from the coronavirus pandemic, including direct patient access to testing without doctor visits; and the profound value proposition of diagnostic testing delivering life-altering information at a fraction of the cost of downstream medical interventions. Quest currently pays a $3.20 dividend (1.8% yield) and repurchases shares opportunistically, with projected earnings per share of $10.50+ in 2026 and $11.50+ in 2027, leading to a price target of $230 per share based on a 20x P/E multiple. Catalysts driving demand include added sugars/high fructose corn syrup, seed oils, overmedication, and overvaccination contributing to the unhealthier population trend.

Read the full article here. Read time: 4 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/122379/?ref=PLACEHOLDER

Author Returns

The below stock pitch is from Tarek Antaki.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

BLOG POST - Tarek Antaki

Live Wire Group, Inc. - $LVWR (short)

LiveWire Group, Inc. manufactures and sells electric motorcycles in the United States, Austria, and internationally. It operates in two segments, Electric Motorcycles and STACYC.

Ticker: LVWR | Price: $4.37 | Price Target: $1 (-77%)

Market Cap: $890M | Timeframe: N/A

🏍️ Electric Motorcycles | 📉 Short Idea

LiveWire Group (LVWR), a $700 million market cap electric motorcycle company that went public via SPAC in September 2022, is massively overvalued with annualized revenue of just $17 million (99.5% below original SPAC forecasts of $892 million by 2025) and 176 units sold in the first half of 2025 versus the projected 53,000 units. The company burns $61 million annually in free cash flow with only $29 million in cash remaining (less than 6 months runway), though it has access to a $100 million convertible facility from Harley-Davidson that remains undrawn. LVWR recently filed a $50 million At-The-Market offering that could more than double the tight float of approximately 10.5 million shares (out of 204 million total outstanding), as Harley-Davidson owns 74% and Kymco owns 4% under lockup until 2029. The stock experienced speculative trading that drove shares from $1 to $9 before settling near $4, but with fundamentals essentially absent and potential supply pressure from new share issuances, the author expects the stock to decline toward its fundamental value below $1. The short position faces a steep 60% borrow cost, but the author believes near-term downside will offset this expense and has over-hedged with calls and warrants to manage risk during potential spikes.

Read the full article here. Read time: 3 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/122390/?ref=PLACEHOLDER

Author Returns

The below stock pitch is from Obscure Stocks.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

BLOG POST - Obscure Stocks

Ranch-to-Market - Queen City Investments - OTC:QUCT

Family-owned holding company

Ticker: QUCT | Price: $1852 | Price Target: $3000 (+62%)

Market Cap: N/A | Timeframe: N/A

💸 Holding Company | 🚨 Event Driven | 📈 Bullish Idea

Queen City Investments, Inc. (QUCT), a family-controlled holding company trading at $1,800 per share versus an estimated intrinsic value exceeding $3,000 (price target $4,340 with 141% upside), represents a sum-of-the-parts opportunity as the Walker family considers monetizing assets after historically poor capital allocation. The company owns F&M Trust, California's oldest state-chartered trust company with $6 billion in fiduciary assets across 1,508 accounts, generating approximately $16.4 million in annual trust fees and an estimated $3-4 million in pre-tax earnings, valued at $30-75 million using 10-15x multiples comparable to peers like Northern Trust and Bank of New York Mellon. QUCT also holds commercial real estate properties generating $1.4 million NOI valued at $20-23 million using 6-7% cap rates, plus a 26,000-acre cattle ranch in San Luis Obispo County that management has committed to selling, worth $39-91 million based on recent comparable ranch sales of $1,500-3,500 per acre. Additionally, the company maintains $34.2 million in cash and Treasury bills ($700 per share) representing excess capital that could be returned to shareholders. The main risks include the historical discount to intrinsic value due to poor capital allocation and limited disclosures, though the discount should narrow as assets are monetized, with excess capital already being returned through share repurchases.

Read the full article here. Read time: 4 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/122369/?ref=PLACEHOLDER

Find all of the stock pitches on https://joinyellowbrick.com (30-day delay for free subscribers).

Unlock all stock pitches (plus historic author returns and Elite Investor Feeds) by upgrading to Yellowbrick Premium.

THE REST OF THE PITCHES

To get access to all of the stock pitches, upgrade to Yellowbrick Road Premium. If part of your job is idea generation (either for your personal account or a fund), it’s a no-brainer.

🎁 REFERRAL PROGRAM 🎁

Use your unique URL below or the share URL for any of the stock pitches to unlock insanely valuable awards.

Premium members have access to these awards here.

THAT’S ALL FOLKS

Thank you so much for reading today’s email! Your support is the only way I can write this email for free every day.

Give me feedback in the poll below and share the newsletter with other investors if you find it useful!

Connor

*Follow Yellowbrick on Twitter at @joinyellowbrick

How would you rate today's newsletter?If you vote 1 or 3 stars, please leave a comment with what you didn't like so I can improve it! |

Reply