- 🟨 The Yellowbrick Road

- Posts

- YB new stock pitches (Wed, Jul 16)

YB new stock pitches (Wed, Jul 16)

Hello!

I’ve just added 49 new pitches to the website.

As always, you can visit the website to see all of the stock pitches and search/filter them at https://www.joinyellowbrick.com (if you are a premium member, make sure to login so you get the most recent pitches).

Thanks for reading!

Connor (founder of Yellowbrick and CEO Watcher)

P.S. - if you want a condensed, links-only view of the stock pitches for faster browsing, you can find it at https://www.joinyellowbrick.com/links

YB PORTFOLIO

New Trade Alert!

We just made a new trade in the YB Premium Portfolio.

The new stock is…

The YBR Portfolio is only available to Premium Subscribers. If you want to know which stocks the top investors are investing in, upgrade to Yellowbrick Premium.

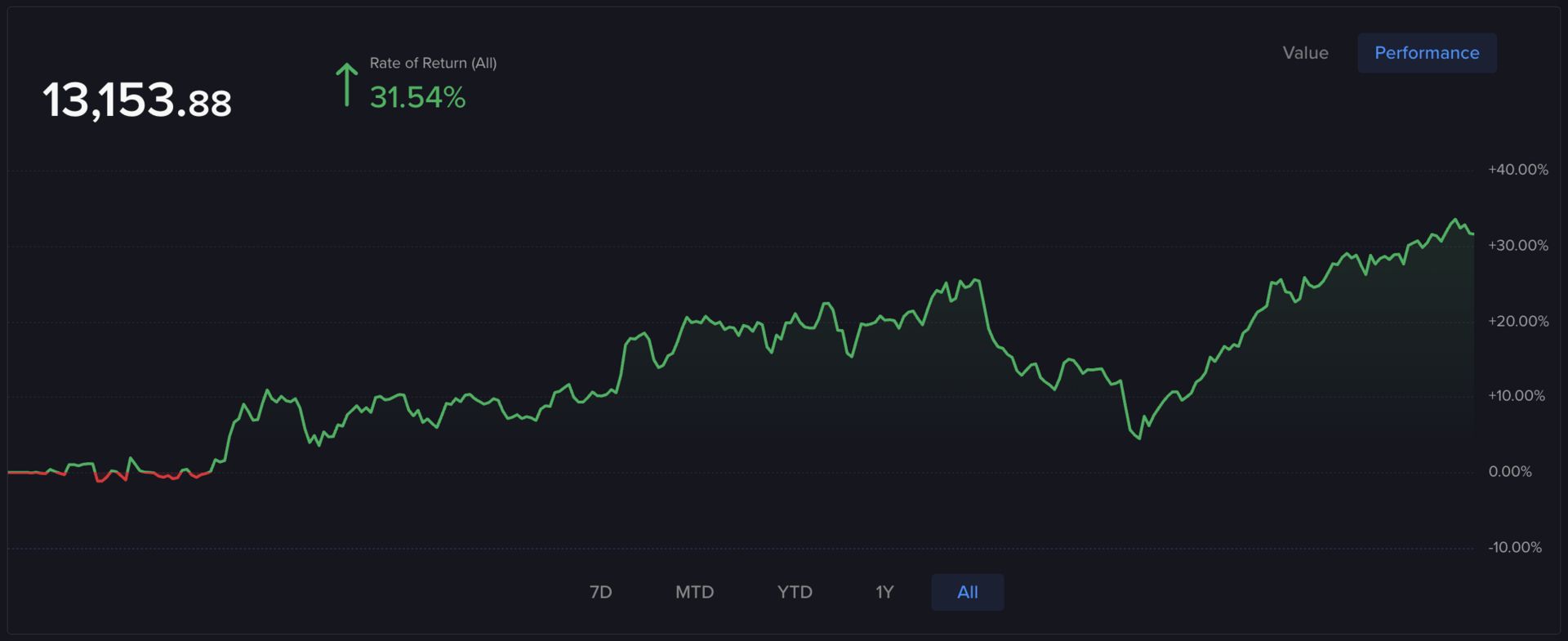

Returns

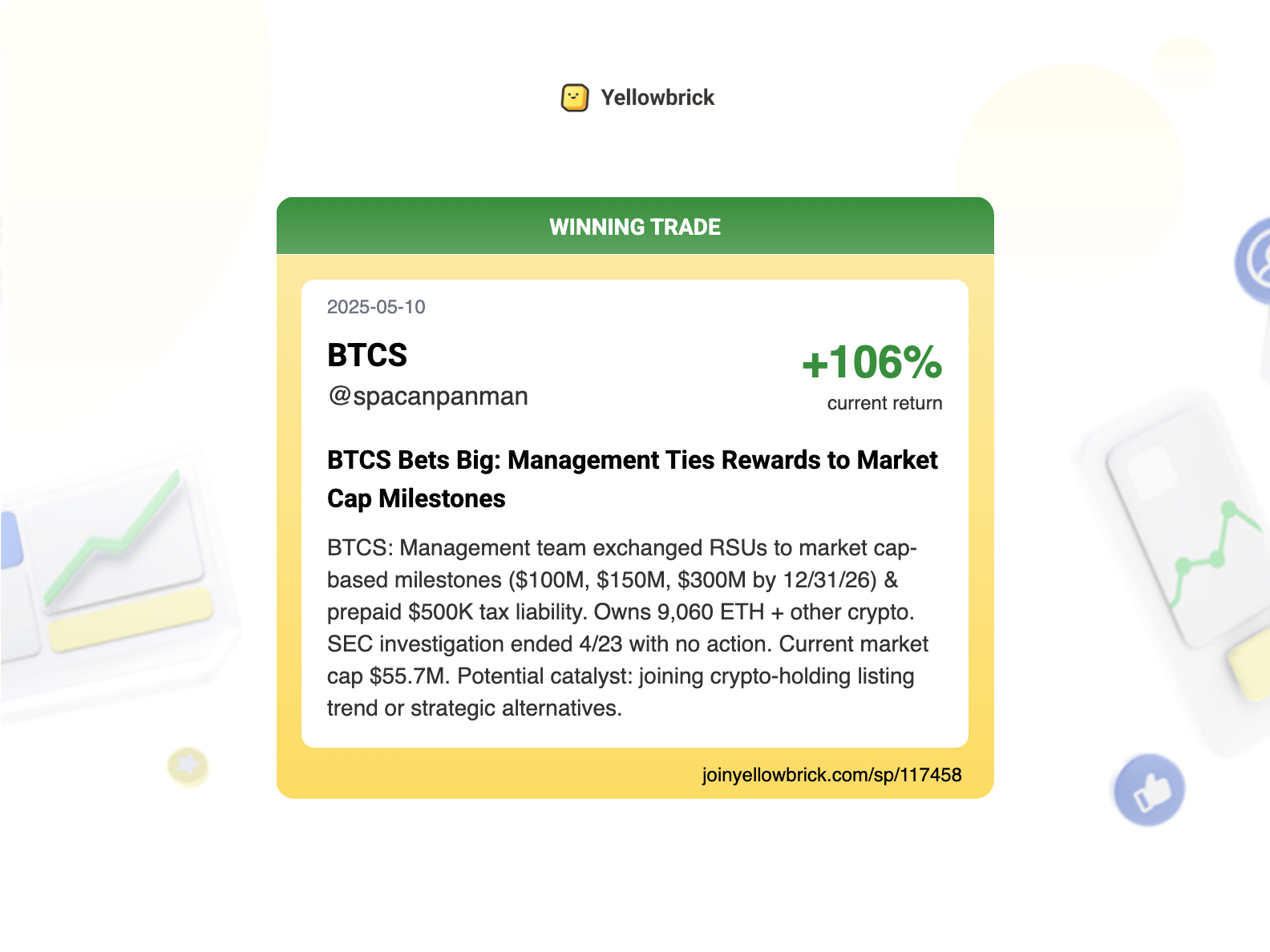

WINNING PITCH

100%+ returns in 2 months

100%+ returns in 2 months on this pitch for $BTCS (link) after the management team exchanged RSUs to market-cap milestones + a bunch of crypto holdings

If you aren’t using https://www.joinyellowbrick.com, you are missing out on tons of killer stock pitches! Hint: check out the Elite Investor Feeds.

HIGHLIGHTED PITCHES (FREE)

Author Returns

The below stock pitch is from Bristlemoon Capital.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

FUND LETTER - Bristlemoon Capital

Bristlemoon Global Fund Portfolio new position: APi Group Corporation

APi Group Corporation provides safety and specialty services worldwide.

Ticker: APG | Price: $34,42 | Price Target: N/A

Market Cap: $14.35B | Timeframe: N/A

🧯 Fire / Life Safety | 📈 Bullish Idea

APi Group Corporation (APG) is a leading provider of statutorily mandated fire and life safety services operating in two segments: Safety Services (74% of revenue, mostly recurring inspection service and monitoring) and Specialty Services (26%, primarily one-time contract work). Following the transformative $3.1 billion acquisition of Chubb in 2022, which doubled its Safety Services segment and expanded international presence, APG's growth algorithm combines mid-single digit organic growth with bolt-on M&A ($250 million annually) to achieve high-single digit revenue growth and mid-teens EPS growth. The company's differentiated inspection-first approach creates sticky customer relationships, with every $1 of inspection revenue generating $3-4 in annual service revenue over time, allowing APG to take market share from fragmented local competitors. Despite strong insider alignment (17% ownership including Co-Chair Martin Franklin's 11% stake), significant dilution has occurred through secondary offerings and preferred stock issuances, with diluted shares increasing from 174 million in 2019 to 282 million in Q1 2025; a particular concern is the Series A preferred stock, which earns a 20% performance fee on share price increases and has resulted in 30.5 million shares issued to date, though this will convert to ordinary shares at the end of 2026, eliminating this overhang.

Read the full article here. Read time: 6 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/120021/?ref=PLACEHOLDER

Author Returns

The below stock pitch is from Eigenvalue.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

BLOG POST - Eigenvalue

Ashtead Technology Holdings: Yellow Submarine

Ashtead Technology Holdings Plc provides subsea equipment rental solutions for the offshore energy sector in Europe, the Americas, the Asia-Pacific, and the Middle East.

Ticker: AT.L | Price: GBP 4.53 | Price Target: GBP 7.93 (+75%)

Market Cap: GBP 364M | Timeframe: 2027

🏗️ Offshore Energy Equipment Rental | 📈 Bullish Idea

Ashtead Technology Holdings (AT.L) is a small but mission-critical offshore energy equipment rental company (78% of revenue) with a 30,000-piece fleet that is 85% fungible between oil/gas and wind markets. The company's equipment is utilized throughout the entire lifecycle of offshore energy projects, reducing cyclicality and oil price dependency. Ashtead has successfully executed multiple acquisitions at attractive multiples (3.9x-5.2x EBITDA) in a fragmented market, including Seatronics (£63m), WeSubsea (£5.6m), Hiretech (£20m), and ACE Winches (£53.5m). Management is aligned with shareholders - CEO Alan Pirie owns 1.65% (£6.1m) and CFO Ingrid Stewart owns £1.4m worth of shares. The company trades at pro forma 5.7x EV/EBITDA and 10.4x PE after the Seatronics acquisition, with £125.5m net debt (1.6x leverage) against a £170m revolving credit facility. Based on projected EBITDA growth to £120m by 2027 and a 7.0x multiple, the equity value could reach £660m (75% upside from current £373m) with 1.5x leverage.

Read the full article here. Read time: 4 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/119987/?ref=PLACEHOLDER

Author Returns

The below stock pitch is from Walnuts Capital.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

BLOG POST - Walnuts Capital

Ai-Media Technologies Ltd ($AIM.AX)

Ai-Media Technologies Limited provides technology-driven captioning, transcription, and translation products and services in Australia, New Zealand, Singapore, Malaysia, North America, and the United Kingdom.

Ticker: AIM.AX | Price: AUD 0.56 | Price Target: N/A

Market Cap: AUD 117M | Timeframe: N/A

📺 Captioning | 📈 Bullish Idea

Ai-Media Technologies (AIM.AX) is a leading captioning provider with approximately 80% market share in US encoders and a growing 55% share of the iCAP network, which connects encoders to AI models or human captioners. The company's Lexi Text captioning product surpasses human accuracy at ~$10/hour versus $100/hour for human captioning, delivering 85% gross margins on SaaS and 70% on hardware. Trading at 2.3x EV/Revenue and 24x EV/EBITDA, AIM is FCF positive with $14M cash. European expansion is gaining significant traction with 150 encoders sold fiscal year-to-date versus 55 in FY24. The company has a competitive advantage through its industry-standard hardware and software that competitors must use for live captioning, and CEO/founder Tony Abrahams owns 17.7% of the company. While 1H25 tech revenue grew only 1.2%, iCAP network usage increased 48% year-over-year, suggesting strong underlying growth despite revenue recognition timing issues from an upfront revenue model change.

Read the full article here. Read time: 4 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/119998/?ref=PLACEHOLDER

Find all of the stock pitches on https://joinyellowbrick.com (30-day delay for free subscribers).

Unlock all stock pitches (plus historic author returns and Elite Investor Feeds) by upgrading to Yellowbrick Premium.

THE REST OF THE PITCHES

To get access to all of the stock pitches, upgrade to Yellowbrick Road Premium. If part of your job is idea generation (either for your personal account or a fund), it’s a no-brainer.

🎁 REFERRAL PROGRAM 🎁

Use your unique URL below or the share URL for any of the stock pitches to unlock insanely valuable awards.

Premium members have access to these awards here.

THAT’S ALL FOLKS

Thank you so much for reading today’s email! Your support is the only way I can write this email for free every day.

Give me feedback in the poll below and share the newsletter with other investors if you find it useful!

Connor

*Follow Yellowbrick on Twitter at @joinyellowbrick

How would you rate today's newsletter?If you vote 1 or 3 stars, please leave a comment with what you didn't like so I can improve it! |

Reply