- 🟨 The Yellowbrick Road

- Posts

- YB new stock pitches (Wed, Jun 11)

YB new stock pitches (Wed, Jun 11)

Hello!

I’ve just added 44 new pitches to the website.

As always, you can visit the website to see all of the stock pitches and search/filter them at https://www.joinyellowbrick.com (if you are a premium member, make sure to login so you get the most recent pitches).

Thanks for reading!

Connor (founder of Yellowbrick and CEO Watcher)

P.S. - if you want a condensed, links-only view of the stock pitches for faster browsing, you can find it at https://www.joinyellowbrick.com/links

YB PORTFOLIO

The YB Tracking Portfolio holds ~30 stocks that were pitched by the best performing investors out of the 2,000+ investors that Yellowbrick tracks. All new trades are shared with Premium subscribers in this email and Premium subs can see the current holdings here.

Last 1y returns

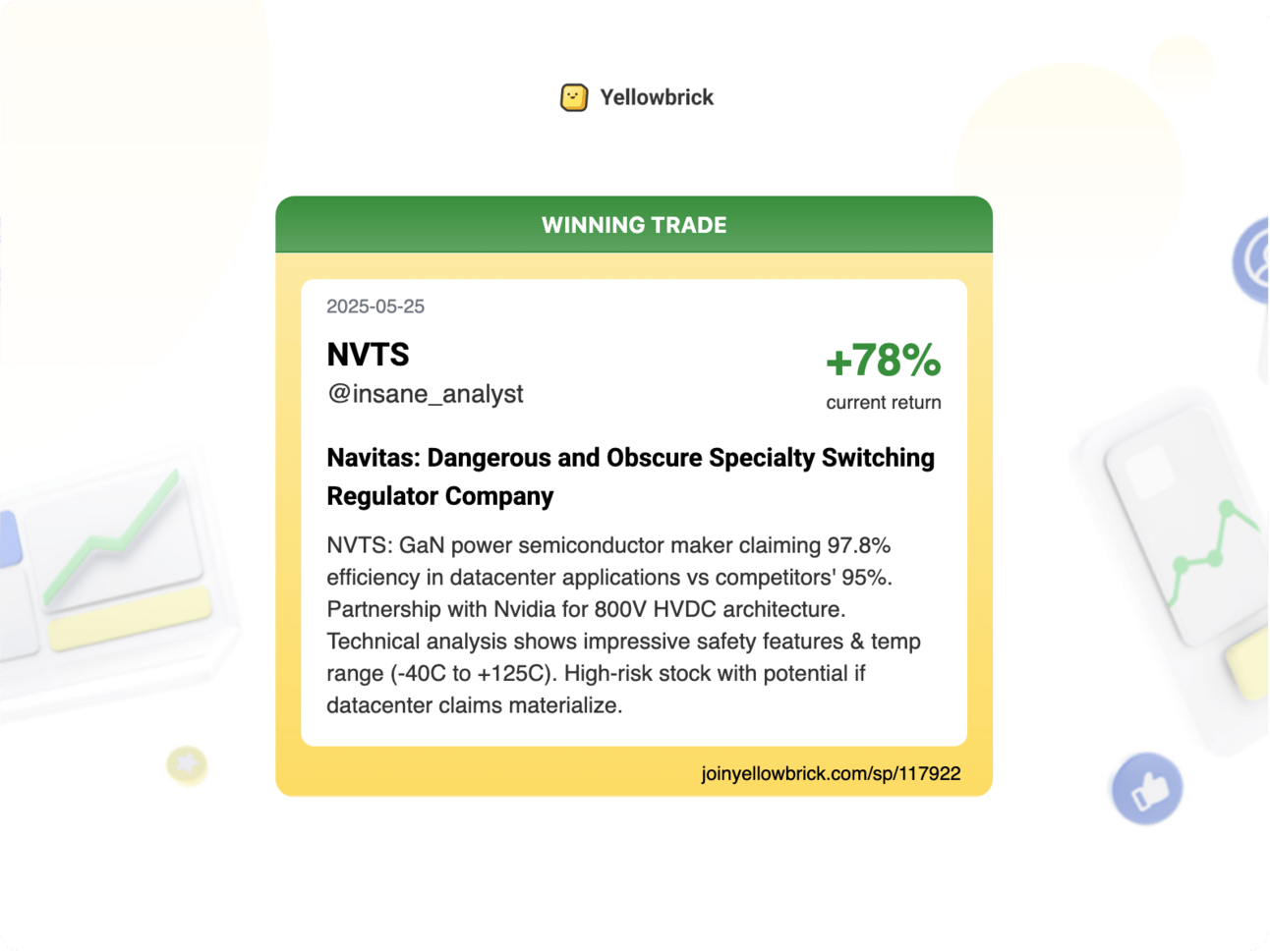

WINNING PITCH

+80% returns in 2 weeks

This Navitas Semiconductor ($NVTS) pitch from the end of May (link) is up almost 80% in just 2 weeks.

If you aren’t using https://www.joinyellowbrick.com, you are missing out on tons of killer stock pitches! Hint: check out the Elite Investor Feeds.

HIGHLIGHTED PITCHES (FREE)

Author Returns

The below stock pitch is from Inflexio Research.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

BLOG POST - Inflexio Research

Quick Pitch: Marcus Corp. (NYSE:MCS)

The Marcus Corporation, together with its subsidiaries, owns and operates movie theatres, and hotels and resorts in the United States.

Ticker: MCS | Price: $17.58 | Price Target: $28 (+60%)

Market Cap: $551M | Timeframe: 2-3 years

🎥 Movie Theaters | 💰 1.6% Dividend | 📈 Bullish Idea

The Marcus Corporation (MCS) is an undervalued theater/hotel operator trading at $17.66, with real estate covering 90% of its market cap at cost ($15.65/share net properties after debt). The stock offers 60% upside potential to $28 as the box office recovers (2025 +24% YTD, Q2 +60% YoY), with 20-30% upside to near-term estimates ($130M EBITDA possible vs $108M consensus) and $155M EBITDA potential by 2026. Management is aggressively buying back shares ($10M in 2024, $7.6M in Q1 2025) and has a history of shareholder-friendly actions, including divestitures, special dividends, and smart capital allocation. Despite being the most shareholder-friendly company in the space with the strongest balance sheet, MCS trades at a discount to peers Cinemark and Cineplex. Free cash flow is improving as the capex cycle normalizes from $80M to $50M, potentially generating $65-70M FCF by 2026 (13% yield). Key catalysts include the 2025 box office recovery and upcoming blockbusters in 2026-2027 (Avengers, Toy Story 5, Shrek 5, etc.). Risks include perception of secular box office challenges and economic sensitivity in the hotel business, though cinema has historically been resilient during downturns.

Read the full article here. Read time: 5 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/118574/?ref=PLACEHOLDER

Author Returns

The below stock pitch is from The Captain's Log.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

BLOG POST - The Captain's Log

[SHORT] Groupon Has Become a GLP-1 Affiliate Marketing and Bootleg Microsoft Office Racket

Groupon, Inc. operates a marketplace that connects consumers to merchants by offering goods and services at a discount in North America and international.

Ticker: GRPN | Price: $32.65 | Price Target: N/A

Market Cap: $1.3B | Timeframe: N/A

🏷️ Discount Marketplace | 📉 Short Idea

Groupon (GRPN) is up 174% YTD due to a fake turnaround heavily reliant on two unsustainable trends: compounded GLP-1 weight loss medications and Microsoft Office 2024 keys (released October 2024), both misleadingly categorized as 'Local' rather than 'Goods' revenue. The GLP-1 business consists of sketchy telehealth providers and med spas offering introductory deals that customers exploit by purchasing multiple trial offers to stockpile medications rather than converting to recurring revenue. Meanwhile, Microsoft Office sales are cyclical, with releases only every three years. Both trends are now reversing as the GLP-1 shortage has ended, FDA regulatory changes have taken effect in April/May 2025, and the Office 2024 cycle is waning. The Czech management team (installed by Pale Fire Capital) deliberately avoids mentioning these key revenue drivers on earnings calls, while evidence shows vendors are already churning off the platform. At $32.94 per share, GRPN faces significant downside as these temporary tailwinds dissipate.

Read the full article here. Read time: 13 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/118584/?ref=PLACEHOLDER

Author Returns

The below stock pitch is from edasc50.

Upgrade to Yellowbrick Road Premium to unlock the historic returns for all authors.

VALUE INVESTORS CLUB - edasc50

NCD Co., Ltd. - $4783.T

NCD Co., Ltd. engages in the system development, support and service, and parking system businesses in Japan.

Ticker: 4783.T | Price: JPY 2979 | Price Target: N/A

Market Cap: JPY 24.34B | Timeframe: N/A

🅿️ System Integrator | 🚲 Bike Parking | 💰 4% Dividend | 📈 Bullish Idea

NCD Co., Ltd. (4783.T) is a Japanese system integrator with modest 6% margins compared to peers' 15%, but features a hidden gem in its market-leading bike parking operation showing strong growth. The system integration business maintains 80% recurring revenue with loyal insurance clients like MetLife and relationships spanning up to 50 years. The bike parking segment offers three contract types (self-operated being most profitable) with typical 5-6 year terms and nearly universal renewal rates. Despite delivering impressive 25% annual returns over the past decade, NCD trades at just 11x PE and 8x EV/EBIT. Governance is above average with five independent directors, though a key risk is the 68-year-old CEO with no named successor. With ¥6B in idle cash dragging down ROE, there's an opportunity for 25% IRR through buybacks, alongside potential for margin improvement in the SI business and continued growth in bike parking operations.

Read the full article here. Read time: 3 min

Share this stock pitch:

https://www.joinyellowbrick.com/sp/118598/?ref=PLACEHOLDER

Find all of the stock pitches on https://joinyellowbrick.com (30-day delay for free subscribers).

Unlock all stock pitches (plus historic author returns and Elite Investor Feeds) by upgrading to Yellowbrick Premium.

THE REST OF THE PITCHES

To get access to all of the stock pitches, upgrade to Yellowbrick Road Premium. If part of your job is idea generation (either for your personal account or a fund), it’s a no-brainer.

🎁 REFERRAL PROGRAM 🎁

Use your unique URL below or the share URL for any of the stock pitches to unlock insanely valuable awards.

Premium members have access to these awards here.

THAT’S ALL FOLKS

Thank you so much for reading today’s email! Your support is the only way I can write this email for free every day.

Give me feedback in the poll below and share the newsletter with other investors if you find it useful!

Connor

*Follow Yellowbrick on Twitter at @joinyellowbrick

How would you rate today's newsletter?If you vote 1 or 3 stars, please leave a comment with what you didn't like so I can improve it! |

Reply